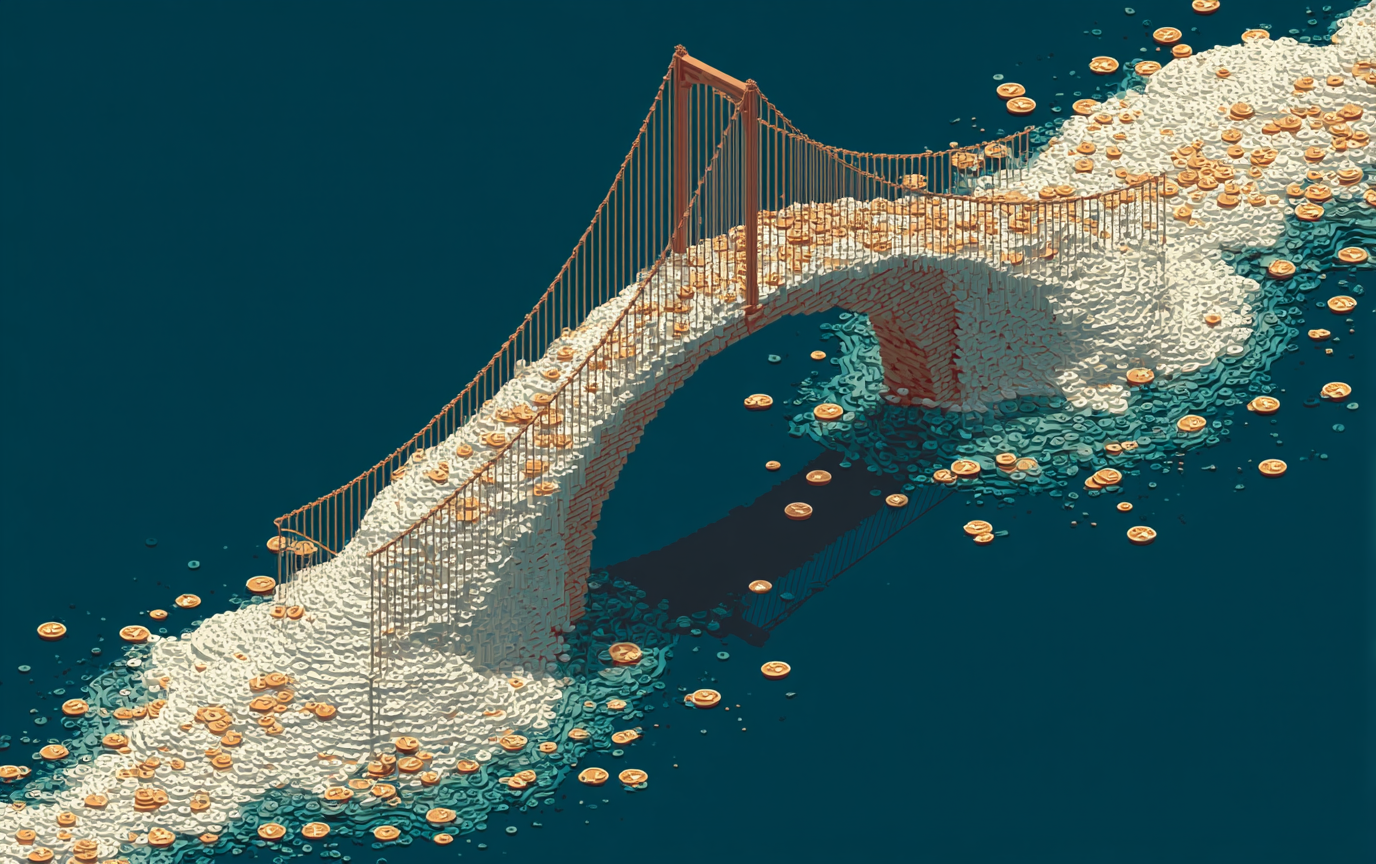

In the dynamic realm of blockchain technology, understanding how crypto bridges work is essential for anyone wanting to navigate the evolving digital landscape. These innovative tools play a pivotal role in addressing one of the toughest challenges within the crypto space: interoperability among different blockchain networks. As the importance of seamless asset transfer grows, exploring the intricacies of these bridges is not just enlightening but vital for your crypto journey.

Now, why is this important? Without bridges, users would be confined to their specific blockchains, unable to access a multitude of decentralized applications (dApps) or utilize the best features of various networks. Bridging these gaps not only enhances the user experience but also scales the entire web of blockchain interactions. Whether you’re a beginner or someone with a bit of experience, this guide will break down the fundamental concepts regarding crypto bridges, their functionality, advantages, and the challenges they face. So, let’s dive in!

What Are Crypto Bridges?

At its core, a crypto bridge is a technology that connects two or more separate blockchain networks, allowing for the transfer of digital assets—like cryptocurrencies and tokens—from one network to another seamlessly. The fundamental idea of these bridges is to facilitate cross-chain transfers. Imagine you want to transfer an asset from your Bitcoin wallet to an Ethereum dApp. A crypto bridge makes this process possible, and one popular example is the Polygon Bridge, which lets you move assets between the Polygon and Ethereum networks. The functionality of these bridges is vital for anyone looking to maximize their cryptocurrency investments and leverage unique characteristics across blockchains. Here’s a simple analogy: think of a crypto bridge as a ferry that takes people from one city (blockchain) to another, providing access to different features, services, or communities.How Do Crypto Bridges Work?

The operation of crypto bridges hinges on a principle known as “wrapping.” When transferring assets, here’s the basic process:- Locking Assets: The original asset on its native blockchain is locked away securely. This ensures that there is no risk of double-spending.

- Creating Wrapped Assets: A corresponding wrapped version of the original asset is created on the destination blockchain. This wrapped asset represents the locked asset on the original chain. For example, when you move Bitcoin (BTC) to the Ethereum network, it is converted into Wrapped Bitcoin (WBTC), which maintains a 1:1 value with BTC.

- Utilization on Destination Network: The wrapped asset can now be used on Ethereum for various purposes, including trading, lending, or participating in decentralized finance (DeFi) applications.

Types of Crypto Bridges

Understanding the types of crypto bridges is crucial for any user. They can primarily be categorized based on how they operate and the degree of trust involved:- Trustless Bridges: These bridges rely on smart contracts—self-executing contracts where the agreement is directly written into code. This ensures transactions are executed correctly without needing a central authority, keeping the decentralized ethos of blockchain intact.

- Trust-Based Bridges: In this model, a central authority or a third-party custodian handles the verification and execution of transactions. While they can be faster, trust-based bridges introduce potential risks such as a single point of failure, which can compromise the integrity of the transactions.

Benefits of Crypto Bridges

Crypto bridges unlock a plethora of advantages for users navigating multiple blockchain environments:- Interoperability: They allow different blockchain networks to communicate and share assets, thus broadening the functionality of various protocols. This connects isolated ecosystems, creating a more cohesive blockchain landscape.

- Scalability: By spreading assets across multiple blockchains, bridges alleviate congestion that often plagues dominant networks like Ethereum. This not only speeds up transactions but also reduces fees, providing users with a smoother trading experience.

- Access to Diverse Applications: Users gain the ability to participate in a wider range of decentralized applications and services, enhancing their options for investment or utility. For example, you could leverage Ethereum-based dApps while holding assets on the Binance Smart Chain.

Risks and Challenges

Despite their substantial benefits, crypto bridges are not without their flaws and potential pitfalls. Understanding these challenges is just as crucial:- Security Vulnerabilities: The complexity of bridges can make them susceptible to hacking. High-profile breaches (like the Ronin Bridge incident) underscore the importance of security in the crypto space.

- Centralization Concerns: Some crypto bridges inherently require more centralized control, compromising their trustless foundations. If a central entity goes down or is compromised, the assets tied to that bridge may become inaccessible.

- Lack of Traceability: Given the pseudonymous nature of blockchain transactions, tracking illicit activities across bridges can become difficult. This raises regulatory and compliance concerns that can affect users and platforms undertaking cross-chain transactions.

The Future of Crypto Bridges

As the landscape of blockchain technology continues to evolve, the future of crypto bridges looks promising. Trends suggest increasing advancements in interoperability protocols that will improve speed, security, and user-friendliness. A focus on decentralized solutions is likely to drive innovation, paving the way for more robust trustless bridges. In addition, we can expect more integration among various blockchain networks as the demand for seamless financial ecosystems grows. Perhaps, in the near future, crypto bridges will not only facilitate exchanges but might also support smart contracts or automated processes across multiple chains, vastly improving operational efficiency. In essence, the role of crypto bridges in the broader context of blockchain technology will continue to expand, making them more integral to everyday transactions.Conclusion

In conclusion, understanding how crypto bridges work unlocks a world of opportunity in the digital currency landscape. These bridges are essential for enhancing interoperability, scalability, and access to diverse applications across various blockchain networks. While embracing the many advantages they offer, users must remain acutely aware of the potential security risks and centralization issues that can arise with these technologies. As the crypto landscape continues to mature, the reliance on bridges is likely to grow, accentuating their importance to both individual users and the overall blockchain ecosystem. If you’re ready to dive deeper into the world of cryptocurrency and trading, explore more guides on Exchainer.com or enhance your knowledge through our Tools and Wallets section. Start your crypto journey today, and don’t hesitate to check the latest updates in our “News” section to stay informed about the ever-evolving world of cryptocurrency! Explore Related Articles:- How to Avoid Crypto FOMO Spending

- What is a Hardware Wallet?

- How to Recover a Lost Crypto Wallet

- Tips for Using a Cold Wallet Effectively

- What is Yield Farming in DeFi?